Vehicle Electronics Ascend Tech Ladder

The average cost for automotive electronics is rising. A decade ago, the average in-vehicle electronics represented about 20% of the total manufacturing cost. Today’s automotive manufacturers are looking at 30-35% or even higher. Drivers want high-end safety and infotainment features even in economical entry-level vehicles. They are also less likely to be brand loyal according to a recent Consumer Report study. Instead, they gravitate to models equipped with standard luxury in-dash electronics.

Popular infotainment, smart phones, navigation tools, and driver-assist applications are pushing in-vehicle connectivity to new heights. Not surprisingly, overly complicated infotainment equipment was the most troublesome feature cited by 2014 vehicle owners. Accustomed to intuitive mobile phones and devices, drivers lose patience with complex control panels and instruction manuals.

From a design perspective, traditional wiring approaches, such as terminals, wire, crimp, poke, seals and wire harnessing assembly boards, are unwieldy and drive up vehicle weight, cost and complexity. In this era of digital cars, space-saving connectors and assemblies can simplify sophisticated electronic systems.

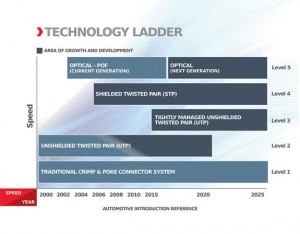

There are five distinct levels of automotive connectivity technology trends—think of it as ascending a ladder—starting with a traditional wire crimp-and-poke approach.

Bandwidth demands brought CAN, FlexRay, MOST Bus, and other technologies into vehicles. Twisted pair wires introduced new manufacturing complexities. Processes improved with automated equipment delivering precise twisting and placement of splice connections along a cable run. Co-ax cable enabled AM/FM antenna applications.

USB was an important gateway for electronic devices to interact with vehicles. Delivering 480Mb/s of data, USB enabled delivery of stored digital music, audio books, and other infotainment. When SerDes (serializer/deserializer) burst onto the automotive scene, the familiar RGB (red-green-blue) wires brought enhanced console displays for built-in GPS mapping plus enhanced video for rear-seat passengers. Shielded twisted-pair connections enabled higher resolution stack displays, back-up cameras, digital instrument clusters, head-up displays, and expanded customer convenience port (CCP) access through digital media hubs for state-of-the-art audio and video.

Designs may soon build off optical fiber systems or variations of plastic optical fiber (POF), which boosts cost and complexity, but can bridge the divide between traditional copper and fiber optics. At every level, we offer reliable and cost-effective options to help automakers satisfy driver expectations for in-vehicle digital content.